us exit tax form

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Get Tax Forms and Publications.

3 Real World Exit Slips In Middle High School Exit Slips Middle School Exit Slips Middle School Writing

Ad Access IRS Tax Forms.

. The IRS Green Card Exit Tax 8 Years rules involving US. Complete Edit or Print Tax Forms Instantly. About Form 1040-NR US.

Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual. The IRS Form 8854 is required for US. Nonresident Alien Income Tax Return About Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b Page Last Reviewed or.

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. Exit tax is a tax paid by covered expatriates on the assets that they own. The Basics of Expatriation Tax Planning.

Green Card Exit Tax 8 Years. Get the current filing. IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US.

Legal Permanent Residents is complex. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. It is paid to the IRS as a part of annual tax returns.

Get Federal Tax Forms. Citizen and certain legal permanent residents who are long-term residents The form is filed when the Taxpayer files. The exit tax in the US is a tax that may apply to US citizens or long-term residents who terminate their US citizenship or residency if they are considered covered expatriates.

If you file your taxes by paper youll need copies of some forms instructions and worksheets. Exit taxes can be imposed on individuals who relocate. Green Card Exit Tax 8 Years Tax Implications at Surrender.

The Form 8854 is required for US citizens as part of the filings to end. Individuals who renounce United States citizenship and certain permanent residents who cease being such may be subject to an alternative tax regime known colloquially as the exit tax or. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or.

You are a covered expatriate if you have become an. Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854. Download or Email IRS 8854 More Fillable Forms Register and Subscribe Now.

At the time of writing the current maximum. Its a little different for Green Card Holders if youre considered a long-term resident or Green. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The idea of the exit tax is the concept that if a US person falls into one of the two categories of being a Long-Term Resident or US Citizen and 1 they have assets that have accrued in value. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The second way you can be required to pay exit taxes is if you have not complied with your US tax obligations in the last five years.

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

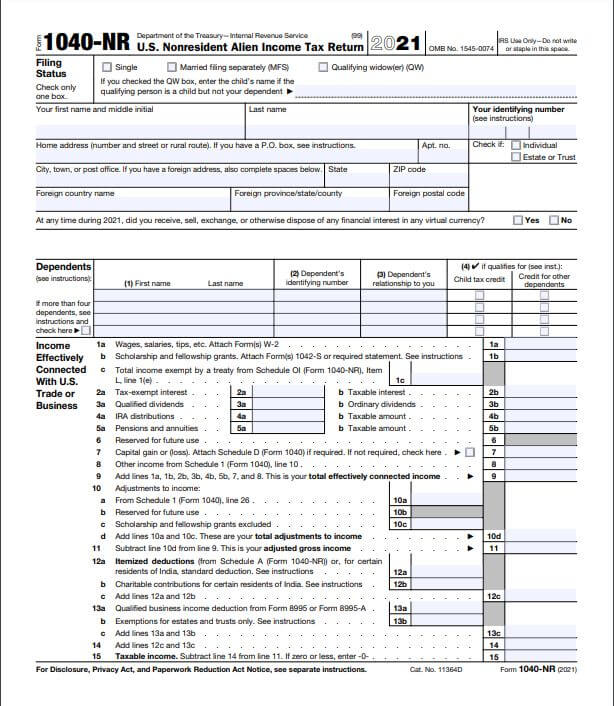

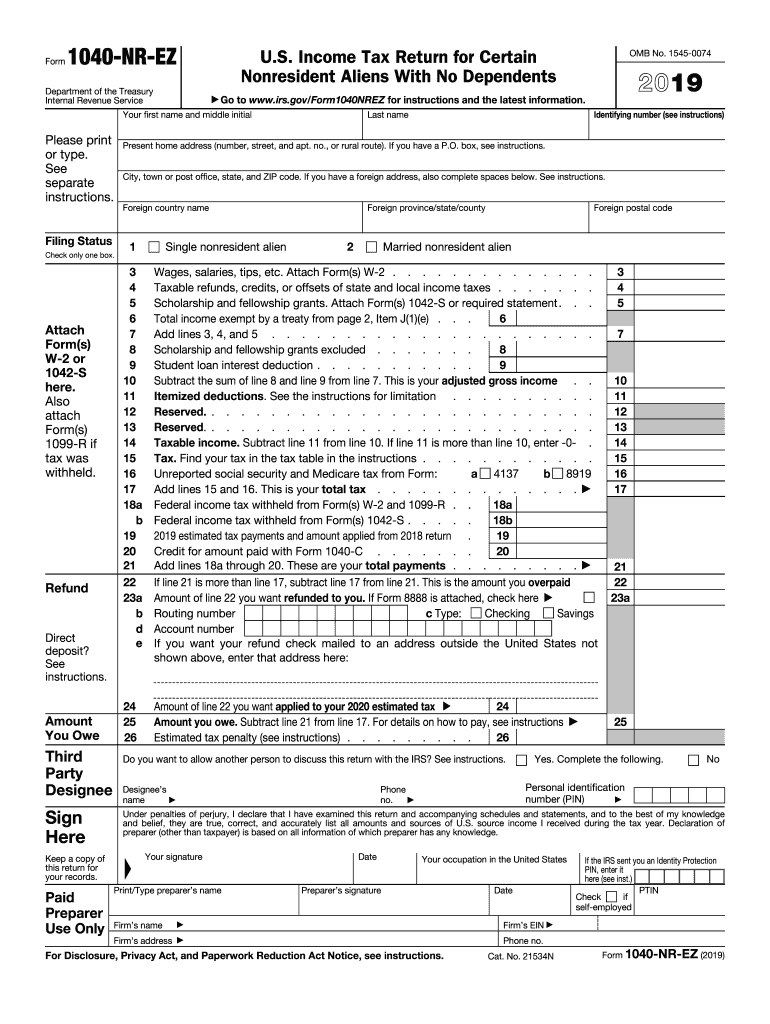

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

Subscription Forms Form Templates Jotform

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

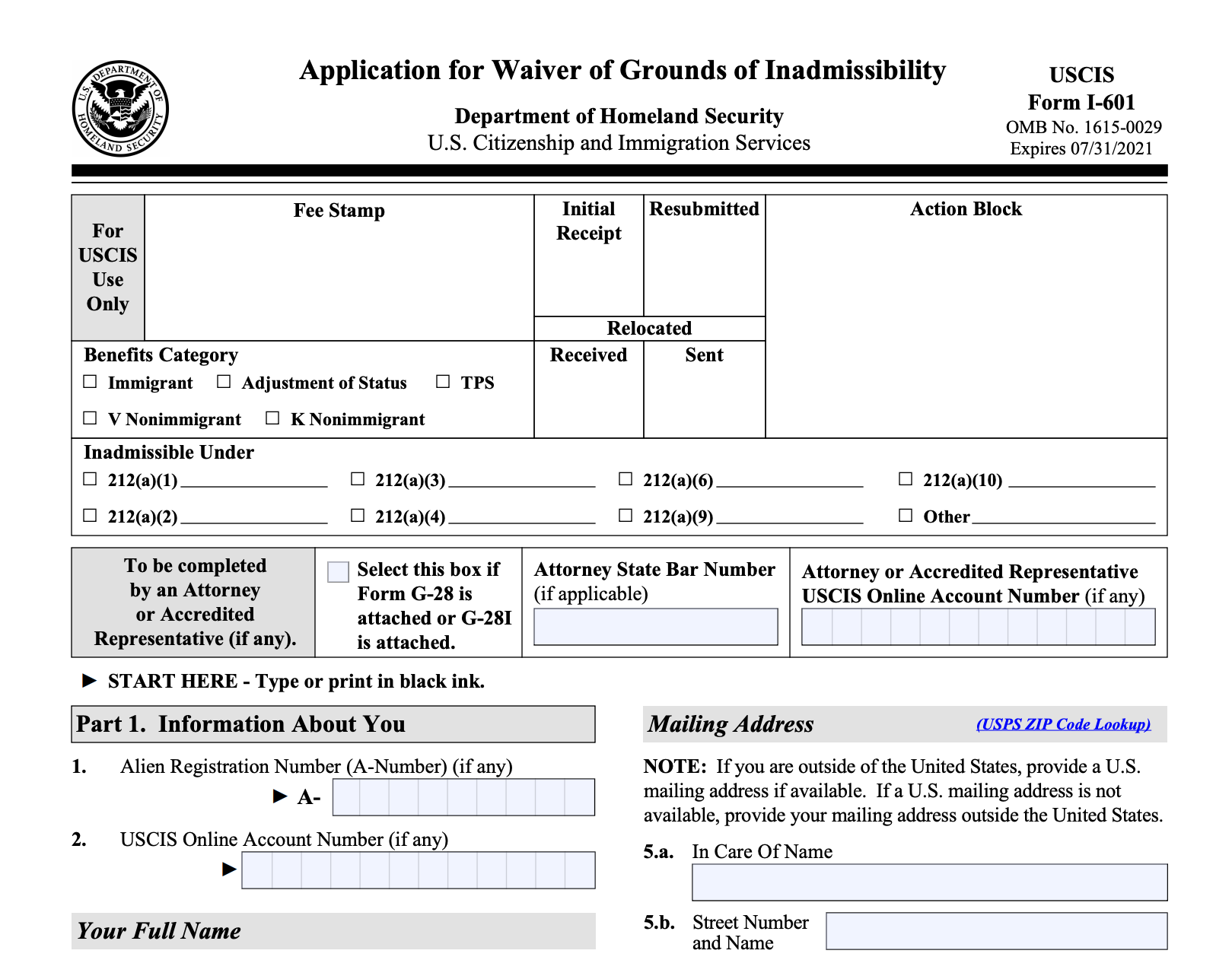

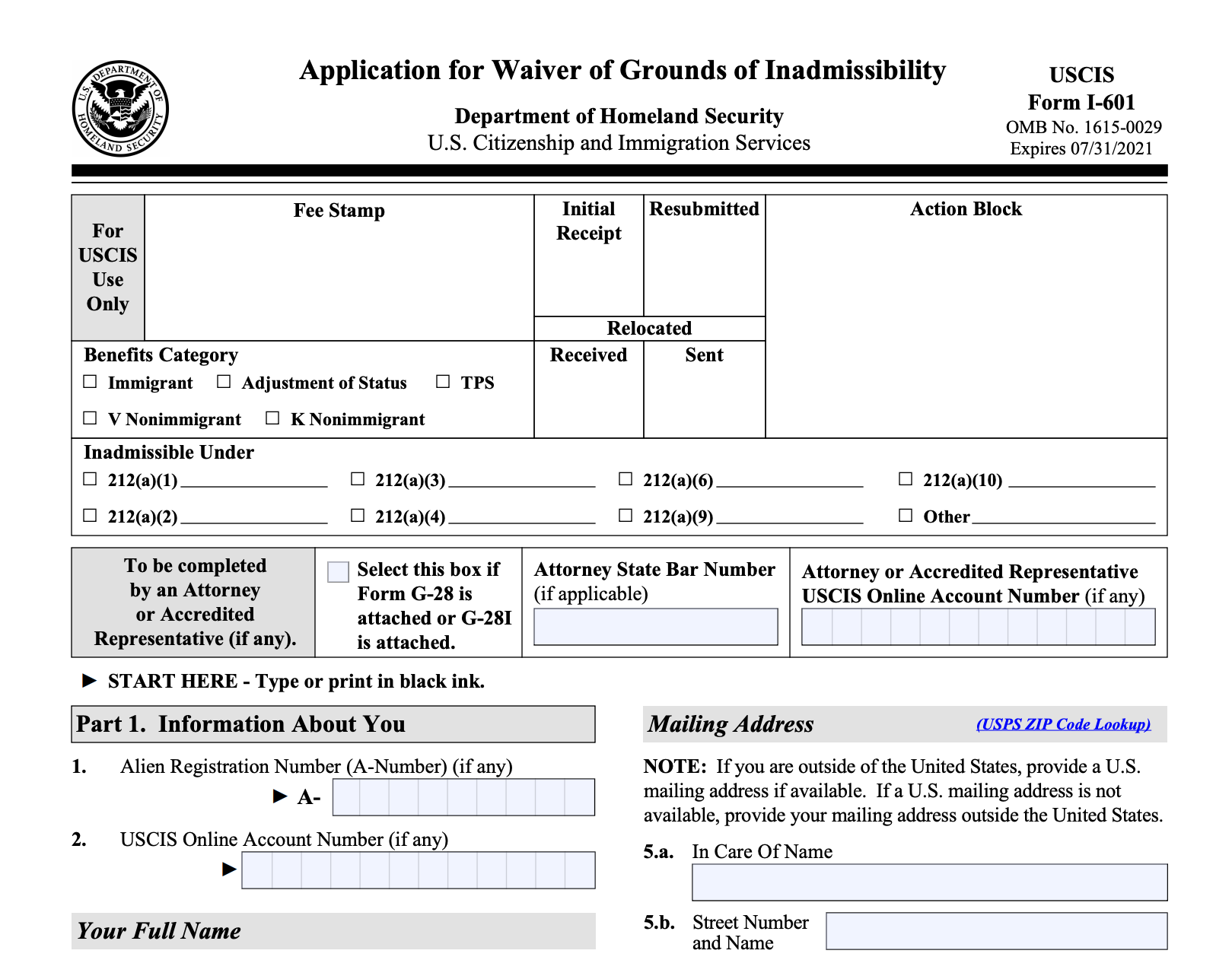

Forms I 601 I 601a Applying For A Waiver Of Inadmissibility

Last Will And Testament Template Real Estate Forms Last Will And Testament Will And Testament Estate Planning Checklist

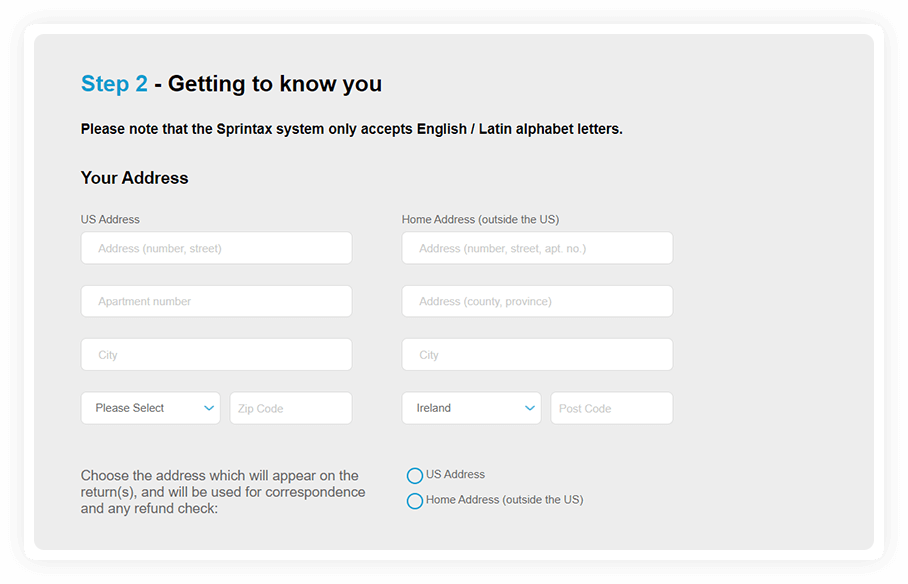

Nonresident Tax Return Software E File 1040nr Sprintax Returns

Treasury 5 Year Yield Falls To Match Record Low Tax Return Filing Taxes Tax Filing System

Donation Form How To Create A Donation Form Download This Donation Form Template Now Donation Form Templates Business Template

Freebie Resources To Help You Teach Your Lesson On Operations With Complex Numbers F Complex Numbers Elementary School Math Activities Geometry Lesson Plans

Sample Notice Of Unpaid Invoice Free Fillable Pdf Forms Letter Sample Sample Resume Lettering

Pdf Nps Withdrawal Form 2021 Pdf Download Critical Illness Nps Higher Education

Form Recognizer W 2 Prebuilt Model Azure Applied Ai Services Microsoft Docs

The Difference An Hour Makes Daylight Savings Time Real Estate Quotes Daylight Savings

Benefits Of Having A Cofounders Agreement Business Help Agreement Starting A Business

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)